For a score with a range between 300 and 850, a credit score of 600 or above is generally considered good. A score of 800 or above in the same range is considered excellent. Most consumers have credit scores that fall between 600 and 750

In the financial landscape of Australia, your credit rating is more than just a number—it's a key indicator of your financial health and a critical factor in determining your eligibility for loans, credit cards, and other financial products.

But you may be asking yourself;

Here at loanoptions.ai, we answer exactly those questions!

You might ask yourself, why you need to have a good credit score to begin with. In the process of acquiring loans or a credit card, you might see in the application process the following;

Provided by commbank

The last of these criteria is to ‘have a good credit rating’.

Your credit rating in Australia is a numerical representation of your creditworthiness. It's calculated based on your credit history, past and current debts, repayment history, and other financial behaviours.

Credit ratings in Australia generally range between 0 and 1,200.

A good credit score opens doors to financial opportunities, offering you the best possible terms and interest rates on loans and credit. In Australia, a score above 600 is typically considered good, with scores above 800 deemed excellent.

Achieving a good credit score suggests to lenders that you're a low-risk borrower, which can significantly ease the process of obtaining financial products such as personal loans, car loans, and credit cards.

Equifax - Credit Score Range | Experian - Credit Score Range | illion - Credit Score Range |

| Excellent: 853-1,200 | Excellent: 800-1000 | Excellent: 800-1000 |

| Very Good: 735-852 | Very Good: 700-799 | Great: 700-799 |

| Good: 661-734 | Good: 625-699 | Good: 500-699 |

| Average: 460-660 | Fair: 550-624 | Room For Improvement: 300-499 |

| Poor: 0-459 | Below Average: 0-549 | Low Score: 1-299 |

Curious about where you stand? The average credit score in Australia varies, but it's a useful benchmark when evaluating your financial health.

Data from credit reporting agencies suggests that the average score hovers around the "good" range which is 600-700.

This average can provide insight into the overall credit health of Australians, highlighting the importance of maintaining a strong credit profile.

Checking your credit rating is the first step toward understanding and improving your financial standing. Fortunately, Australians have access to several free services to check their scores.

Leading credit bureaus such as Equifax, Experian, and illion offer free annual credit reports. Additionally, various online platforms provide free, instant credit score checks.

This makes it easier than ever to stay informed about your credit health.

The range for credit ratings is a good indicator of your credit score, but in the end, its really what the lenders think is good!

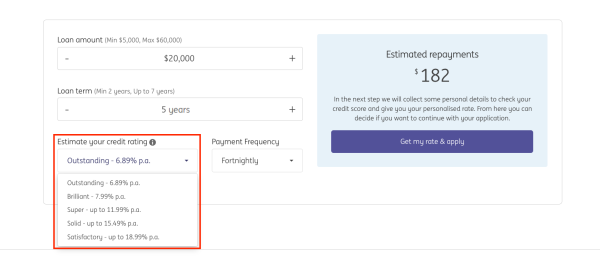

For example, at ING the value of your credit rating will affect your interest rate on the loan you apply for;

You can see how much effect this has on your borrowing.

The takeaway here is, that it can pay to get quotes from MULTIPLE lenders based on your credit score.

The difference between them based on very slight credit score changes can be massive.

Improving your credit score is a journey that requires patience and discipline. Here are some strategies to enhance your score:

Credit score categories can differ slightly in terminology across various platforms, yet they universally encompass five distinct levels:

| AGE | AVERAGE AGE | AVERAGE EQUIFAX |

| 18-24 | 21.6 | 626.88 |

| 25-34 | 29.8 | 631.74 |

| 35-44 | 39.32 | 630.95 |

| 45-54 | 49.05 | 622.44 |

| 55-64 | 58.15 | 673.18 |

| 65+ | 70.24 | 756.35 |

| GENDER | AVERAGE AGE | AVERAGE EQUIFAX |

| Female | 40.1 | 626 |

| Male | 39.17 | 641.24 |

| STATE | AVERAGE AGE | AVERAGE EQUIFAX |

| NSW | 38.81 | 680.66 |

| QLD | 40.44 | 576.21 |

| VIC | 40.24 | 605.88 |

| WA | 40.59 | 565.7 |

| SA | 39.43 | 622.71 |

| ACT | 39.6 | 582.58 |

| TAS | 42.71 | 586.26 |

| NT | 39.35 | 578.3 |

| AVG FOR All STATES | 39.55 | 610.46 |

Your credit score is a vital component of your financial identity in Australia. Understanding what a good credit score is, how to check it, and ways to improve it are essential steps in securing your financial future.

A strong credit rating does more than just facilitate loan approvals; it's a reflection of your financial discipline and reliability. By leveraging your good credit score, you can negotiate better interest rates, secure higher credit limits, and enjoy more flexible loan terms. This, in turn, can lead to significant savings and a more comfortable financial position over time.

To maintain or achieve a stellar credit rating in Australia, consider adopting a proactive approach towards your finances:

Understanding and improving your credit score in Australia is a journey towards financial empowerment. It enables you to make more informed decisions, access better financial products, and ultimately achieve your financial goals with greater ease.

A key piece of your financial puzzle in Australia. By understanding what a good credit score looks like, how to check and improve your score, and the impact it has on your financial opportunities, you're better equipped to navigate the complexities of the financial world. Remember, a strong credit score is within reach with the right habits and strategies.

Start taking steps today to enhance your financial future tomorrow.

I hope you're now better prepared to understand, manage, and improve your credit rating in Australia. Whether you're checking your score for the first time or looking to improve an already good score, the journey towards financial health and empowerment starts with informed actions and consistent management of your credit.

As mentioned, a score above 600 is generally considered good, with higher scores indicating better “creditworthiness”.

The maximum attainable credit score ranges between 1,000 and 1,200. Achieving the pinnacle of credit scoring, often regarded as the 'perfect' score, remains a rarity among consumers.

Nonetheless, striving to increase your score can make a big difference when applying for your next loan or credit card.

To improve your credit rating (positive actions):

To lower your credit rating (negative actions):

You can get your credit score for free through comprehensive credit reporting bureaus like Equifax, Experian, and illion, or via online platforms that offer instant credit rating checks.

Loan Options predictive AI can match you with the best loans for using your circumstances, without impacting your credit score. Chat with our team about how you can improve your credit score so you never have to stress about getting the finances you need.